The UAE it’s putting its chips on the global appeal of big, branded amusement parks to boost its tourism sector

- Theme parks serve as an additional strategic lever in the UAE’s competitive strategy to attract tourists - and more importantly, to encourage them to stay longer

- Studies find that international branding is not particularly significant in driving attendance – instead, personalized, integrated experiences will be the clincher

Abu Dhabi Chamber of Commerce and Industry (ADCCI) recently sat down with Wes Schwalje, COO of Tahseen Consulting, to discuss the United Arab Emirates’ plan to become a regional and global themed entertainment destination with its sizable investments in theme parks.

ADCCI: What value do theme parks bring to the UAE’s tourist proposition?

Schwalje: In 2016 the World Travel and Tourism Council estimated travel and tourism contributed approximately $227 billion to Arab economies and employed approximately 6 million people. This means that the contribution of the travel and tourism sector to regional gross domestic product is on par with the banking, chemicals, agriculture, and automotive sectors. It is clear that travel and tourism will play a strong role in generating economic growth and employment in the Arab World over the next decade.

According to the World Travel and Tourism Council, in 2016, travel and tourism contributed $43 billion to the UAE economy.

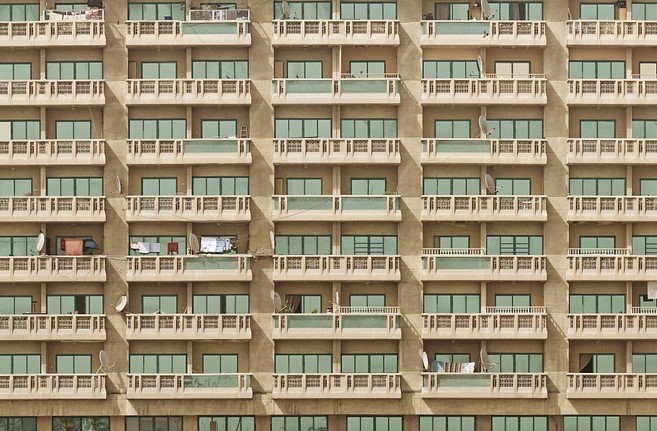

In the UAE, travel and tourism has been identified as a key sector for economic growth and diversification. For this reason, the UAE has invested significantly in the travel and tourism sector to position itself as a destination of choice for international leisure and business travelers. The UAE’s more recent investments in theme parks complement the country’s already significant legacy investments in world class resorts, hotels, golf courses, and other attractions. Theme parks fill an existing gap in the types of visitor attractions the UAE offers.

The UAE is world-renowned for its beaches and adventure tourism given its unique ecosystem. Over the last decade, it has launched a number or sporting, culture, shopping, and festivals which have been effective tourist draws.

Heritage tourism has received a lot of investment in the run up to Expo 2020. Theme parks serve as an additional strategic lever in the UAE’s competitive strategy to attract tourists. It shouldn't be ignored that some studies have shown that typically, residents from within 1.5 to 2 hours of a theme park, can account for as much as 80% of theme park visitors.

ADCCI: What kind of traveler will theme parks attract?

Schwalje: The business proposition of UAE theme park investments is rooted in the oft cited statistics that 6 billion people live within eight hours flying time to the UAE and Dubai and Abu Dhabi airport passenger traffic collectively amounts to approximately 100 million people. The idea is to convert these travelers into theme park guests.

Based on the top source markets for UAE visitors, theme parks are likely to attract travelers from India, Saudi Arabia, United Kingdom, Oman, Pakistan, US, China, Iran, Germany, and Kuwait. However, it remains unclear how the UAE theme park might ultimately evolve. For example, key theme park clusters in Florida and California in the United States have carved out a niche which attracts visitors that are ready to travel long distances and stay in parks for long periods. In Florida, for example, overseas visitors have an average length of stay just above 10 days.

In the UAE, the average length of visitor stay is approximately 4 days.

So it is unclear if the UAE theme park market will evolve similar to the model of California and Florida or if it will evolve more closely to European or Asian theme park markets which often have considerably shorter lengths of stay and cater largely to more proximal geographic markets.

ADCCI: What kind of peripheral spends will these travelers bring?

Schwalje: Based on visitor spending trends globally, in addition to direct tourist spending on accommodation, transport, and entertainment, theme park tourists will also bring significant spending on shopping, sightseeing, dining, and other recreational activities. The indirect and induced spending impacts from tourism can be as significant as or higher than the direct contribution of travel and tourism to GDP. This implies that extending visitors’ length of stay should be a key priority for UAE tourism promotion authorities and key stakeholders.

ADCCI: How should the UAE optimize theme park segmentation? What types of parks work best?

To maximize revenues, UAE theme parks will need to quickly transition from selling 7-hour experiences to a 7-10 day experience. This will require doubling the average length of visitor stay in the UAE.

Schwalje: While a large scale critical mass of theme parks and attraction is critical, a key challenge will be encouraging overnight stays by increasing suitable accommodation across all market segments.

ADCCI: Do ‘internationally branded’ parks, such as Legoland, offer more value and footfall?

Schwalje: Theme parks generally have two broad strategies for attracting customers: leveraging original local content or global alliances. In the UAE, theme parks have generally chosen the strategy of forming global alliances for intellectual property assets to make their parks appeal to a broader international audience. Empirical studies of the impact of park theming surprisingly show that theming is not particularly significant in driving entry prices and attendance – attractions seem far more important.

There is no conclusive evidence that international branding is a golden ticket to success.

However, consumers are becoming more globally aware, and other rapidly developing competing theme park markets, such as China which opened more than 20 theme parks in the past few years, have followed a similar international branding approach to UAE theme parks.

ADCCI: What might theme parks of the future look like?

Schwalje: The theme park industry, like other industries, evolves based on economic conditions, global competition, socio-political developments, and technological developments. An interesting study conducted recently asked over 100 theme park leaders about their views on the future of the theme park industry. A few of the themes that emerged from this study were: top future themes for parks will be interactive adventure, fantasy and mystery, movies and TV shows, science fiction, and space; the family market will always be the target market for parks; operational excellence, such as reduced wait times and dynamic pricing, will become key points of future differentiation; visitors will demand more interactive, personalized experiences; and theme parks will have to offer integrated vacation experiences that include on-property accommodations, food services, recreation, shopping, recreational and entertainment activities, and other tourist services. We see many of these themes playing out now.