Measuring Corporate Social Responsibility in the Arab World

- Only 1% of the 4,650 organizations which are registered and have filed reports on the Global Reporting Initiative’s Sustainability Disclosure Database, are Arab

- We draw on 128 regional initiatives and past literature to create an Arab CSR Rapid Appraisal Diagnostic

Arab companies make up just 1% of the 4,650 organizations which are registered and have filed reports on the Global Reporting Initiative’s Sustainability Disclosure Database. Global Reporting Initiative registration and filing statistics point towards adoption of reporting standards in only a select few countries, primarily in the Gulf, in the oil and gas, construction, financial services, and telecom sectors and to a more limited extent in the government and healthcare sectors.

Even with the growing acceptance of the Global Reporting Initiative’s standards, at least amongst large Arab companies, as a common reporting framework, how and what is being reported differs substantially between companies making the standards more a benchmark of content rather than a framework that enables cross organizational comparison of actual economic, environmental, and social performance. A list of the companies which have registered and filed at least one report is included at the end of this post.

The Dominance of Small and Medium Enterprises Suggests A Reason Why the Global Reporting Initiative’s Corporate Social Responsibility Reporting Standards are Not Widely Used in the Arab World

Though the reasons for the lack of adoption of Global Reporting Initiative standards in the region are unclear, the industrial structure of the region in which small and medium sized enterprises dominate economic activity is one plausible explanation. Much has been written about small and medium sized enterprise opacity in the Arab World stemming from weak financial infrastructure, lack of use of accounting and financial reporting standards, and lack of human resources to implement financial and accounting standards (see for example the 2011 report on the Status of Bank Lending to SMEs in the Middle East and North Africa Region or the reports of the intergovernmental working group of the United Nations Conference on Trade and Development on international accounting and reporting standards).

The Global Reporting Initiative mission “to make sustainability reporting by all organizations as routine as, and comparable to, financial reporting” suggests a critical causal link between the adoption of financial and accounting reporting standards and corporate social responsibility reporting that allows us to conclude with reverse causal inference that widespread adoption of financial and accounting standards is likely to precede adoption of corporate social responsibility reporting in the region.

In this way, the limited use of Arab small and medium sized of financial and accounting standards likely serves as a limiter for the adoption of corporate social responsibility reporting.

This logic chain potentially explains why the Arab companies which have registered and have filed reports on the Global Reporting Initiative’s Sustainability Disclosure Database tend to be comparatively large, publicly listed companies which have strong capabilities in applying international financial and accounting standards to regulatory filings.

A Rapid Approach to Appraising the Corporate Social Responsibility Initiatives of Arab Companies

Given the scattered use of Global Reporting Initiative standards in the region, Tahseen Consulting has developed an Arab Corporate Social Responsibility Rapid Appraisal Diagnostic based on analysis of a representative sample of 128 regional CSR initiatives and previous literature.

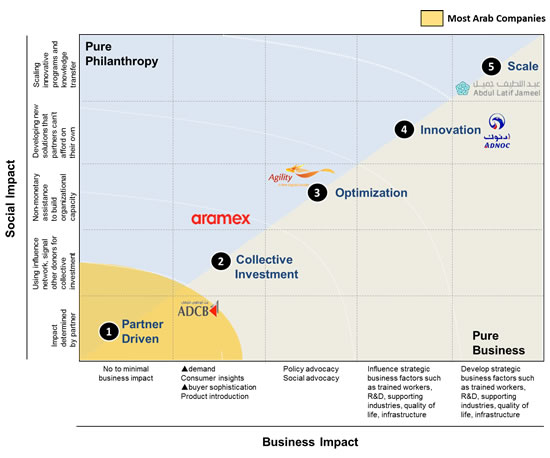

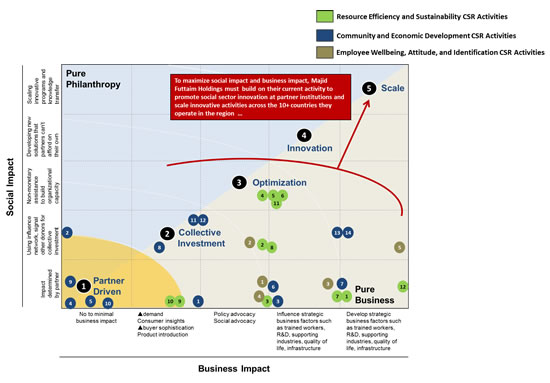

Our diagnostic is based on a matrix by which we assess corporate social responsibility initiatives along two dimensions, social and business impact, while balancing philanthropic aspirations with commercial objectives. We view social impact as a sequential path that ranges from charitable activities that are bound by the activities of social sector partners to social investments that facilitate social sector innovation and initiative scaling while building the capabilities of social sector institutions. Similarly we view the business impact of social sector investments as ranging from charity-based initiatives with little business impact to more transformative social sector investments that allow companies to influence social, political, and strategic business factors such as trained workers, R&D, supporting industries, quality of life, and infrastructure.

Our aggregate data analysis of publically available accounts of 128 of the region’s corporate social responsibility programs reveals several key findings about corporate social responsibility in the Arab World:

- There are few programs that address social and business goals simultaneously

- Most Arab companies have diffused, unfocused giving

- Companies are offering small cash donations for operating expenses

- The emphasis of many CSR programs is publicity, not social impact

- There are many examples of cause marketing aimed at goodwill over social impact

- There is very little partnership with other entitles that also have corporate social responsibility programs

- Many companies support the same entities with little emphasis on innovation

An Example: Appraising the Corporate Social Responsibility Initiatives of Majid Al Futtaim Holding

Since 2010, Majid Al Futtaim Holdings, a large family-controlled retail and hospitality conglomerate based in the UAE with operations in several countries in the Arab region, has had a corporate social responsibility strategy in place.

Based on publicly available sources, Majid Al Futtaim Holding devotes $7.4 million to CSR annually which includes both cash and significant in kind donations of commercial space.

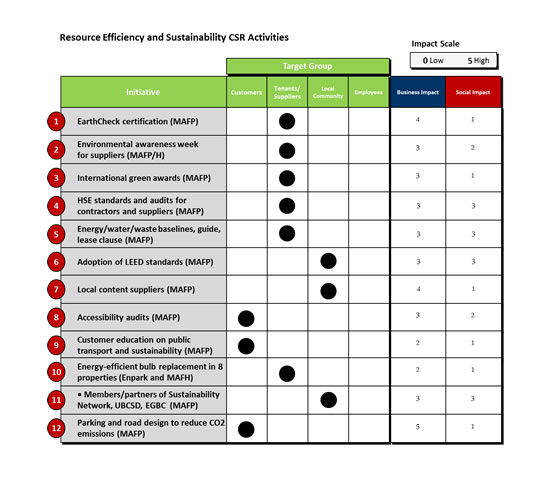

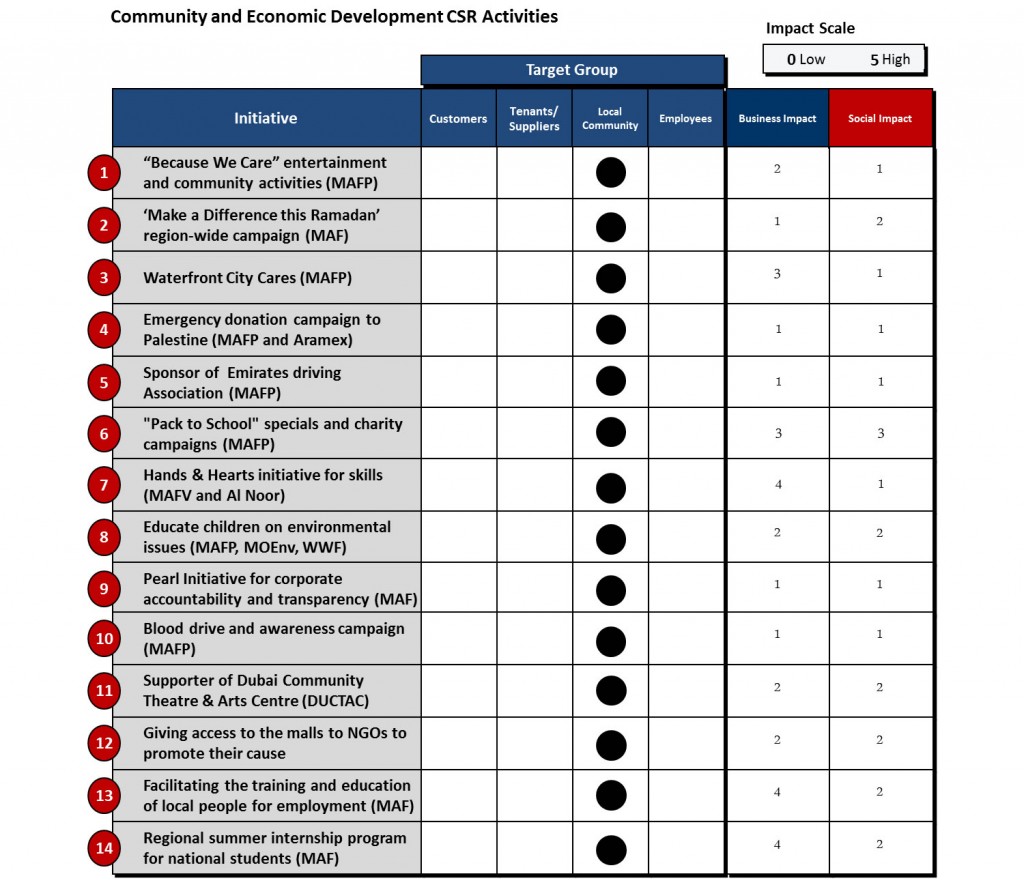

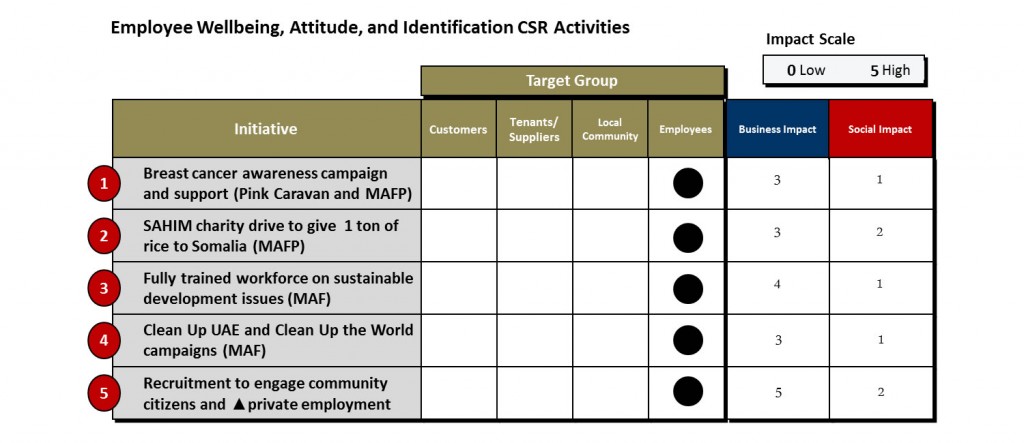

Based on an analysis of the annual report for their property division which is likely indicative of the practices across other divisions, Majid Al Futtaim Properties has a number of corporate social responsibility policy aims but its current disclosures do not provide sufficient level of detail to adequately assess social impact of their programming or link their programs to the achievement of specific stated social aims. Based on press accounts, Majid Al Futtaim Holdings has approximately 31 corporate social responsibility programs in three focus areas: resource efficiency and sustainability, community and economic development, and employee wellbeing, attitude, and identification. These initiatives are targeted at customers, tenants and suppliers, local communities, and their employees. A list of their CSR initiatives is shown below.

Though we do not have sufficient information for a detailed social impact assessment of Majid Futtaim Holding’s corporate social responsibility initiatives, we are able to determine that a number of their programs are at the partner-driven stage or represent investments that might require work to more effectively engage the social sector to develop institutional capabilities and more innovative approaches to social challenges.

Significant effort must be placed on scaling innovative activities across the 10+ countries they operate in the region.We have included our assessment of Majid Futtaim Holding’s corporate social responsibility activities using the Arab Corporate Social Responsibility Rapid Appraisal Diagnostic below.

Though we do not have sufficient information for a detailed social impact assessment of Majid Futtaim Holding’s corporate social responsibility initiatives, we are able to determine that a number of their programs are at the partner-driven stage or represent investments that might require work to more effectively engage the social sector to develop institutional capabilities and more innovative approaches to social challenges.

Arab Companies Which Have Filed Reports on the Global Reporting Initiative’s Sustainability Disclosure Database

UAE (28 companies)

- Abraaj Capital

- Abu Dhabi Gas Liquefaction Company

- Abu Dhabi International Centre for Organizational Excellence

- Abu Dhabi National Oil Company (ADNOC)

- Abu Dhabi Tourism Authority (ADTA)

- Abu Dhabi Water & Electricity Authority

- ADCCI (Abu Dhabi Chamber of Commerce & Industry)

- Aldar Properties

- Borouge

- CEMEX UAE

- Department of Economic Development – Abu Dhabi

- Department of Municipal Affairs, Abu Dhabi

- Department of Transport Abu Dhabi

- Dolphin Energy

- DU

- Dubai Customs

- Dubai Properties Group

- Emirates Foundation

- Energy Management Services

- Environment Agency Abu Dhabi (EAD)

- Jordan Energy Management Services

- Jumeirah Group

- Metito

- National Bank of Abu Dhabi (NBAD)

- RAK CERAMICS

- Sama Dubai

- Sorouh

- Zones Corp

Jordan (9 companies)

- Arab Bank

- Jordan River Foundation (JRF)

- Nuqul Group

- Aquaba Container Terminal (ACT)

- Aramex

- Electricity Distribution Company EDCO

- Zain Jordan

- Schema

- Jordan Aircraft Maintenance (Joramco)

Saudi Arabia (7 companies)

- Dr. Soliman Fakeeh Hospital

- Majid Society

- Saudi Aramco

- The National Commercial Bank (NCB)

- The Saudi Investment Bank (SAIB)

- International Medical Center (IMC)

- Zain KSA

Kuwait (5 companies)

- Burgan Bank

- Kuwait Finance Housing

- National Bank of Kuwait

- Agility

- National Real Estate Company

Qatar (3 companies)

- Qtel

- RasGas

- QAFCO

Oman (2 companies)

- National Bank of Oman

- Tawasul/Global Connections Center

Bahrain (1 company)

- Gulf Petrochemical Industries Company

Palestine (1 company)

- Paltel Group

Egypt (1 company)

- SEKEM Group