Global autonomous vehicle companies are increasingly vying to launch pilots across the region

- The GCC, led by Dubai in the UAE, is setting a regional precedent in developing regulation, investing in innovation testbeds, and launching early pilots with global tech companies

- With Expo 2020 to be hosted in Dubai and progress being made on foundational regulations, 2020 will be a critical year for the MENA in becoming a global leader in autonomous tech

The GCC is poised to be a major global center for the development and deployment of autonomous vehicles (AV) with the significant investments by GCC countries to become smart cities and build modern transport systems set to make the commercialization of autonomous vehicles a very near reality. Governments, together with companies, and investors are paving the way - literally and figuratively - for the roll out of an entirely new urban ecosystem, predicated on efficient, safe, and affordable autonomous transportation. While the United Arab Emirates (UAE) is currently leading the way, the race to an autonomous future is still undecided as other countries like Saudi Arabia and Qatar are following at a safe distance behind.

In the GCC, initial pilots by early adopters of autonomous technologies are taking place across a variety of use cases including driverless taxis, buses, freight movement, and goods delivery. However, lack of harmonized regulations in GCC and MENA countries is slowing the adoption of autonomous technologies and holding back critical testing and pilot deployments. While Dubai recently introduced Resolution No (3) of the Executive Council Regulating Test Runs of Autonomous Vehicles, a clear testing process – including interim operating frameworks for piloting passenger-carrying commercial autonomous vehicles and trucks with and without safety drivers – is needed in the UAE and across the region.

With the right approach, the MENA could be the first region to commercially deploy viable autonomous vehicles without manual controls, like steering wheels and pedals, and the need for safety drivers.

Initial Pilots are Paving the Way for the MENA’s Autonomous Future

Due in part to mobility featuring prominently in Expo 2020 and early support for autonomous vehicles at the World Government Summit starting in 2018, the UAE is emerging as a global leader in government policies and programs to support AV adoption.

True to its reputation as a first mover, the Dubai Roads and Transport Authority (RTA) launched a driverless taxi pilot in Silicon Oasis.

In April 2019, RTA published the Dubai Autonomous Transportation Strategy with the target of conducting 25% of all transport journeys via autonomous vehicles by 2030. The establishment of Dubai’s AV test track at Silicon Oasis, the first of its kind in the MENA, has been a further draw for global AV tech leaders seeking to pursue trials and explore opportunities in the region in a bid to win the biannual $5 million Dubai World Challenge for Self-Driving Transport.

Similarly, Abu Dhabi’s Surface Transport Master Plan envisions leveraging autonomous technologies to enhance sustainability and support Abu Dhabi’s economic and social goals with an initial deployment planned to connect Yas Island with the Airport and ongoing pilots under the MoU between Abu Dhabi Department of Transport and Masdar. Abu Dhabi’s Masdar City deployed the first autonomous vehicle pilot in the MENA when it launched personal transport pods in 2010. Masdar’s early cooperation with 2GetThere and SMRT Singapore reflected progressive thinking that has more recently led to a deal with Ion and Navya on the deployment of autonomous shuttles. Sharjah has also begun to deploy autonomous vehicles through a partnership between the Sharjah Research, Technology, and Innovation Park and ION-Navya.

Due to the UAE’s growing diplomatic relationship with China, dealplomacy has led to closer ties with Chinese AV companies.

In July 2019, Neolix and Noon, a joint e-commerce venture between Saudi Arabia’s Public Investment Fund and investor Mohamed Alabbar, announced a partnership to pilot AVs in Abu Dhabi and Dubai for last-mile deliveries. Al Abbar’s additional agreement MoU with Chinese ridesharing company Didi could also lead to a robotaxi pilot in Abu Dhabi. In late 2019, AutoX, a world leader in robotaxi services and the first to operate a robotaxi service in California, announced its intention to pilot the UAE and MENA’s first commercial robotaxi in Dubai by the end of 2020.

Partially as a result of lack of regulatory leadership, the UAE’s neighbors have generally been back seat passengers to its progress. In Saudi Arabia, the King Abdullah University of Science and Technology launched the Kingdom’s first autonomous vehicle pilot with Local Motor Industries and EasyMile. Saudi Arabia is also considering a pilot test track in Riyadh to open later in the year and is planning AV pilot deployments in smart city projects like the NEOM Megacity. Qatar also recently announced a partnership with Volkswagen to deploy electric autonomous shuttles and buses to complement the significant investments it is making in public transport.

Developing the Foundations for MENA Leadership in Autonomous Vehicle Technologies

The MENA is entering a critical period of innovation where a synergy of government, regulatory reform, and piloting opportunities is creating favorable conditions for AV investment. The region’s emphasis on R&D in autonomous technologies, artificial intelligence, and 5G makes it a strategic choice for global tech companies for piloting self-driving vehicles.

The GCC’s current AV pilots are the first of an anticipated new wave of more significant investment into transportation innovation that can establish the MENA as a global leader in commercializing self-driving vehicles.

With the largest Emirates in the UAE co-opeting on AVs as part of their transport strategies and innovation agendas, there is an urgent need to ensure a progressive, rather than reactive, approach to working with the private sector on regulations. Regional AV regulations should not start from scratch — they should build on the progress that has already been made in jurisdictions that present international best practices for testing and deployment, like California in the United States and several cities in China. Dubai’s RTA, due to its regional influence in cutting edge transport technology policies, is very likely to shape MENA-wide AV regulations — AV regulatory precedents from Dubai are likely to be adopted at the federal level and replicated regionally in key markets such as Saudi Arabia, Egypt, and Pakistan.

The MENA’s initial AV pilots are not just for showing early leadership in a promising technology but are also aimed at building user trust.

In January 2020, a survey of UAE residents revealed that half would like to own a self-driving car in the next five years if it were available. Those who expressed doubt in AVs raised several key concerns, including doubts about the technology’s ability to function effectively on the road, its ability to spot and react to road hazards, and the risks to pedestrians. The data reveals a critical need for interactions between people and AVs in real-world situations to overcome apprehension.

Another important step in reinforcing public trust was the Emirates Authority for Standardization and Metrology’s project which began in 2017 and led to the development of the UAE technical regulations that include safety requirements and specifications for self-driving vehicles. The standards, likely to be finalized in 2020, will become a blueprint for the GCC and other MENA countries to implement performance and safety requirements as they also begin to pilot autonomous vehicles. In February 2020, the RTA also introduced legislation intended to streamline the regulatory process for piloting AVs which will serve as a model for other jurisdictions. The RTA’s regulations, which include mandatory comprehensive insurance and civil responsibility, provide a replicable model for other MENA government AV fast follower strategies.

2020 and Beyond: Expo 2020 to Spark MENA Cooperation of Autonomous Technologies

This year will be a critical year for self-driving vehicles. Following GITEX and the 1st Dubai World Self-Driving Congress in 2019, it has become clear that the UAE is a leading destination for global tech companies seeking to commercialize some of the world’s first autonomous vehicle technologies. However, there is an urgent need to create a transparent and scalable permitting process and regulatory framework for commercial deployment to secure the UAE and MENA’s first mover advantage. Right now, only very basic non-commercial use cases of autonomous technologies have been deployed, while several progressive global jurisdictions, such as the United States and Asia, are already making steps toward commercial deployment of AVs.

Expo 2020 will be a critical opportunity for companies, firms, and investors to further interact and test AVs first-hand.

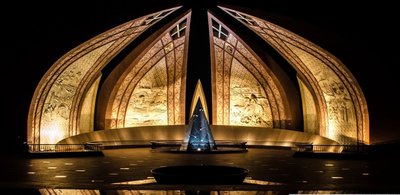

Similar to South Korea’s K-City and the United States’ Mcity, - both unpopulated testing ground cities for autonomous vehicle testing with 5G networks, Expo 2020 will feature a testing environment for autonomous vehicles. Dubai will also play host to the 2021 International Road 18th World Conference and Exhibition and 2nd Dubai World Self-Driving Congress where it is expected to showcase a number of world-leading achievements in autonomous aerial and passenger vehicles.

However, a series of coordinated, regionwide actions will be necessary to capitalize upon the UAE’s early AV leadership and cascade progress across the region:

Convene a MENA-wide AV Advisory Board: Made up of experts and advocates in a broad range of sectors impacting AVs, including manufacturing, transit, delivery, mobility, and technology, such a Board would study emerging AV-related safety, security, and privacy issues and make recommendations on existing and proposed policies and safety requirements in partnership with regional governments. As a regional coordinating body, the board would also address intra-regional discrepancies in safety standards and facilitate coordinated industry promotion and research efforts.

Develop MENA AV Technical Specifications: Based on the UAE’s progress, standards bodies can collaborate to develop consistent regional technical specifications and requirements that enable trade and the manufacturing of AVs. Progressive specifications would account for regional differences in road infrastructure conditions, traffic cultures, and regulations whilst ensuring the highest global standards established by international best practices.

Build a MENA AV Test Facility: As part of the Arab Digital Economy Strategy, the Arab League could support the development of a proving ground for testing connected and autonomous vehicles and technologies under controlled, realistic conditions before deploying them on public streets and highways.

Invest in Soft-landing Programs: Many countries have gotten a head start on the MENA. However, AV innovators can be attracted to the region with welcoming deployment testbeds that promote regional research and technology transfer. Such testbeds could be established in partnership with regional investors and companies in key sectors, such as trade and logistics, to build long-term foundations for global competitive advantage in autonomous technologies.

The GCC’s emerging global leadership in autonomous technologies, and adjacent technologies like 5G and AI, presents an unprecedented opportunity for the MENA to attract talent, tech companies, and investors before the global race for autonomous tech leadership is decided.The potential societal and economic benefits of AVs are significant. Autonomous vehicles can play a strong role in the MENA’s pursuit of sustainable transport while also shifting transport modalities to more shared, public forms over personally-owned, less sustainable vehicles.

As autonomous technology use cases grow, societal benefits expand to include collision-related cost savings, cost savings from travel time reductions, fuel efficiency savings, and parking benefits.

As a result, AVs have the potential to be transformational in increasing transport equity and providing mobility for underserved populations that can make up for the region’s historical shortfall in public transport spending. While driverless taxis will likely be the first commercial application of autonomous vehicles in the MENA, under the right policy environment, further novel applications of autonomous technologies, as well as their economic and social benefits, can be far-reaching. However, the time for MENA governments to unlock these benefits is now — before the global race for autonomous tech leadership becomes more congested.