FinTech's potential to become a pillar of the Arab World’s socio-economic development

- FinTech players are increasingly challenging traditional payment firms’ intermediary role by offering more direct, faster, and cheaper services

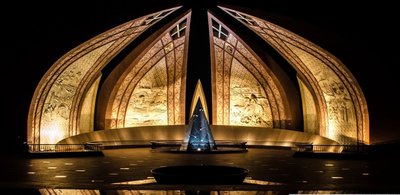

- Abu Dhabi is reaping the rewards of the FinTech revolution by providing the regulatory framework and safe space to innovat that are financial services companies looking for

In a brief interview with Abu Dhabi Chamber of Commerce and Industry, Tahseen Consulting’s Wes Schwalje talks about Abu Dhabi’s race to become a global FinTech hub. This race is not just about superlative bragging rights, though Abu Dhabi Global Market’s Reglab is the first FinTech regulatory sandbox and framework in the MENA region. The economic stakes are real and significant with FinTech having the potential to become a key pillar of the Arab World’s socio-economic development.

Abu Dhabi Chamber of Commerce and Industry: Why is Abu Dhabi so attractive to FinTech companies?

Schwalje: In 2016, the Financial Services Regulatory Authority published a consultation paper seeking industry views on a FinTech legislative framework. This consultation led to Abu Dhabi Global Market establishing the Arab World’s first FinTech regulatory regime and regulatory laboratory. The initiative follows in the footsteps of similar competing FinTech regulatory sandboxes globally.

Countries such as UK, Singapore, Hong Kong, and Australia which are all vying to become FinTech hubs.

These cities are all providing a safe space for FinTech businesses to test innovative products, services, and business models without having to initially comply with more traditional legal and regulatory requirements for the financial services sector.

The more recent commitment Abu Dhabi has shown to embracing FinTech as well as its traditional role as a strong player in the regional financial services sector make it a very attractive base for more established financial institutions exploring Fintech as well as startups experimenting with innovative financial products or services.

The embrace of FinTech in the UAE is an evolution of the initial vision to position the country and its constituent Emirates as a unified international financial services hub offering a full spectrum of financial services comparable to other leading global financial centers.

Abu Dhabi provides the regulatory framework, safe space to innovate, strong government support, and commitment to a long-term vision that financial services companies look for when it comes to pushing the innovation frontier. Additionally, there are several regional factors which make Abu Dhabi attractive. Though estimates vary significantly, the unbanked population in the Arab World is estimated at upwards of 80%. Traditional commercial banks continue to dominate lending with weak service provision for small and medium sized businesses which make up more than 90% of most Arab economies. Estimated at $7 billion, e-commerce across the Arab World is booming with a youthful, technology embracing demographic which are first movers when it comes to embracing technological innovation.

Abu Dhabi Chamber of Commerce and Industry: How could FinTech help improve the Middle East and Abu Dhabi?

Schwalje: It is not clear at this time what the full range of possible use cases for FinTech will be in the region, but a few macro trends are emerging based on the startups in region and competitive pivots of more established financial services firms. The payments industry is becoming more competitive with FinTech players challenging traditional payment firms’ intermediary role by offering more direct, faster, and cheaper services.

We are seeing significant innovation in mobile wallets, crypto-currencies, and block chain technology as well as mobile banking surging.

Digital and mobile-based payments will likely replace traditional card-based payments and make some traditional payment channels like ATMs and point of sale technologies obsolete. Block chain-driven payment infrastructure, which Dubai is pioneering, have the potential to significantly reduce payment processing costs. Web-based insurance aggregators are challenging the dominance of more traditional market players.

We will see the increased use of big data by financial institutions to more effectively serve SMEs and previously unbanked populations with tailored deposit and lending facilities.

Online platforms have already caught on as an alternate funding platform for entrepreneurs seeking early-stage finance to counter the lack of risk capital and commercial loan options for startups and SMEs in the region. Right now we are at very interesting stage in the evolution of FinTech regionally in which there remains significant big addressable markets that are currently untapped.