Abu Dhabi is the Second Most Preferred Regional Destination for Foreign Investors

- Abu Dhabi currently offers foreign investors a high level of political and economic stability, strategic location, world-class infrastructure, and tax incentives

- To keep an edge on the growing competition, the emirate must reduce limitations on foreign ownership and sponsorship requirements

Abu Dhabi Chamber of Commerce and Industry (ADCCI) recently sat down with Wes Schwalje, COO of Tahseen Consulting, to discuss how Abu Dhabi can attract more foreign investment.

ADCCI: What makes a country attractive for foreign investment?

Schwalje: There is widespread agreement that foreign direct investment flows are influenced by the size and growth of the investment destination, stability, openness, and institutional quality. This consensus is built upon a foundation of a number of stylized facts: larger economies tend to attract more foreign investment; trade openness and export orientation have a strong complementarity with FDI flows; sectoral and cluster effects often signal opportunity for foreign investors that increase investment, political and macroeconomic stability attracts investors; and good governance and institutional quality are key FDI determinants.

However, emerging research on FDI shows that bilateral trade agreements, investment treaties, and customs unions potentially have a much higher influence on FDI attraction than macro-economic policy factors like business costs, infrastructure, and quality of political institutions.

So, in addition to a continuing focus on strengthening the business enabling environment in the GCC, we will likely also start seeing a much stronger focus on bilateral and multilateral trade and investment frameworks.

ADCCI: What credentials can Abu Dhabi leverage to boost and optimize its FDI?

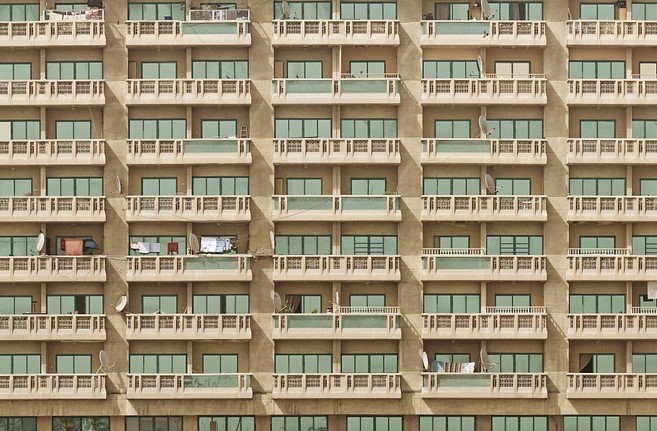

Schwalje: Abu Dhabi currently offers foreign investors a high level of political and economic stability, strategic location, world-class infrastructure, tax incentives, and strong social infrastructure. It is currently the second most preferred destination of foreign investor in the Arab World. However, there are several competing, emerging FDI destinations in the Arab World which raise questions about how investment destinations can further differentiate themselves from competitors.

ADCCI: What sort of FDI related policies and incentives could attract investors to Abu Dhabi?

Schwalje: In general across the GCC, there is a need for deeper reforms to enhance the business enabling environment and simplify investment approval and licensing. One of the most significant concerns of potential investors in the GCC, which the UAE is currently addressing at the federal level, is limitations on foreign ownership and sponsorship requirements often contained in GCC investment laws.

Investment laws which give investors greater control over their investments will be critical.

Over the longer term, several GCC countries will need to consider if the investor incentives and protections offered by economic and investment zones that primarily target foreign investors should be rolled out more broadly to benefit onshore businesses. Stepped up policies to support small and medium enterprises are needed. A stronger focus on bilateral investment treaties and free trade agreements can build on the achievements GCC countries have made in improving the business enabling environment. Clarifying the role of countries and the Secretariat General of the Gulf Cooperation Council in promoting FDI could also provide a stronger regional framework for FDI attraction.