How the budding Emirati publishing eco-system can maintain momentum

- A small, enterprising national publishing industry has sprung up as the UAE has made significant educational gains

- Key challenges that will determine the progress of the industry include export competitiveness and the cultivation of indigenous reading culture

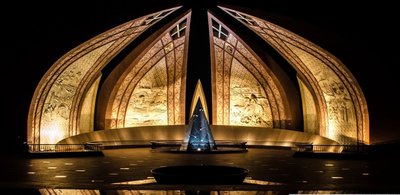

The Frankfurt Book Fair is one of the world’s most important and well visited book fairs. It has emerged as a key forum to define the agenda for the global publishing industry. This year, the United Arab Emirates (UAE) will be a featured market. As a featured market, the UAE will have the opportunity to showcase its growing publishing industry, expand trade links, and attract foreign investment from international publishers and retailers.

In the run up to the event, Tahseen Consulting was asked by the Frankfurt Book Fair organizers to contribute its thoughts on the key challenges facing the UAE publishing industry. We have conducted several regional and country level analyses on the challenges facing domestic publishing industries in the Arab World such as our landmark publication on Saudi Arabia’s publishing industry which supported the Saudi Publishers Association’s promotion as a full member of the International Publishers Association.

For over a decade, Tahseen Consulting has been involved in many of the Arab region’s initiatives to enhance the competitiveness of domestic publishing industries.

We are honored to have contributed our thoughts on the key challenges the UAE publishing industry must address to consolidate and build on the significant growth the industry has experienced over the last several years. At Frankfurt Book Fair, Tahseen Consulting’s Chief Executive Officer Walid Aradi will be discussing these challenges as well as potential market opportunities in more depth.

Challenges the UAE publishing industry must address in its next growth phase

Just four decades ago, 48% of Emiratis were illiterate. Today, the illiteracy rate has dropped below 1% due to the United Arab Emirates’ focus on improving access to quality education for all. The United Arab Emirates’ significant educational, social, and economic gains, have produced an increasingly globalized and educated population eager to consume more locally produced and culturally-relevant content, particularly in Arabic.

In the last decade, a small, enterprising national publishing industry has sprung up to meet growing demand.

The United Arab Emirates’ publishing industry is evolving at a transformative time –publishers are faced with the challenge of redefining an industry which has traditionally focused on ink-to-paper content by finding new and innovative ways to merge high-value Arabic content and technology to meet evolving reader demand. Despite the youth of its publishing industry, the United Arab Emirates has the potential to become a global hub for international and regional publishers, distributors, and other complementary creative sectors. The industry is projected to grow at a compound annual growth rate of 12% to 2030. However, additional growth could be achieved if several industry concerns are addressed.

Enhancing export competitiveness of Emirati publishers

In 2014, book exports from the UAE were $40 million versus imports of $126 million based on the most recent customs data available. Over the last decade UAE book exports have grown at a compound annual growth rate of 1%, while imports have grown at a compound annual growth rate of 8%. Book publishing has so far failed to contribute to the diversification of the United Arab Emirates’ exports. These statistics show that the UAE publishing industry remains insular and inward looking primarily due to its youth. The low number of titles produced in the UAE, estimated at approximately 500 titles per year and unique demographic structure, partially explains the imbalance between book import and exports, but the industry faces a range of other significant challenges that reduce export competitiveness.

Though changing due to increased participation in international book fairs, the international publishing community still has little awareness of the emerging UAE publishing industry.

A growing portion of UAE titles are of sufficient quality and appeal for global export. For example, Emirati-authored books now make up 11% of the top-selling Arabic books in the UAE.

Furthermore, Kalimat’s children’s book Tongue Twists was recently awarded the Bologna Children’s Book Fair Award. However, international publishers and literary agents still remain largely unaware of UAE published titles. An interesting initiative by Spain, called New Spanish Books, which provides an online guide of titles from Spanish publishers and literary agents available for foreign rights sales, is potentially a program that could be replicated in the UAE to increase awareness of the titles of Emirati publishers with export potential.

Enhancing export competitiveness of publishers will require an industry wide effort.

At the most foundational level, this will require bringing together government entities that are concerned with the promotion of cultural industries and economic diversification as well as civil society institutions like the Emirates Publishers Association, and publishers.

At the publisher level, two significant issues must be addressed: enhancing the market responsiveness of domestic publishers to operationally respond to the internationalization and globalization of the publishing industry and building the capacity of domestic publishers to access international markets through translation, selling foreign rights, and international marketing and promotion.

While use of Arabic is a common denominator which promotes export to other countries in the Arab World, export statistics show that UAE books also have a broader appeal in countries such as the UK, US, Germany, Spain, and Italy.

Though there are several government backed industry support initiatives, such as translation and rights trading grants, more comprehensive publishing industry support programs, potentially similar to the Canada Book Fund, could be more impactful in increasing the export competitiveness of domestic publishers and addressing firm-specific challenges that limit export capacity.

Strengthening the domestic production of learning materials

Approximately 54% of UAE book imports are textbooks primarily from the UK and US. Imported textbooks generally cover science and mathematics subjects while domestically produced textbooks, which are primarily published by the Ministry of Education, cover humanities and religion subjects.

Emerging research on textbooks and their relationship to learning outcomes suggests a link between textbook design features, student reading levels, and student performance – engaging textbook content with practical application to students’ lives influences reading of textbooks which ultimately affects student learning outcomes.

The high portion of imported textbooks and regional textbooks which lag socio-cultural development, combined with other factors like poor quality teaching, may ultimately be having a significantly negative effect on student learning outcomes.

Evidence of this complex linkage is potentially found in the UAE’s performance on the 2011 Progress in International Reading Literacy Study in which the UAE ranked 40th out of 45 countries in terms of average reading achievement at the 4th grade level. Because of the influence that learning and teaching materials have on learning outcomes and reading skills, a key challenge which must be addressed is ensuring that educational materials are appropriate to the local context and do not perpetuate cultural and gender stereotypes which are at odds with evolving national values. The production of quality, Arabic children’s books and digital content is also essential to complement Arabic teaching with age-appropriate, culturally relevant material to inspire children and help educators teach more effectively.

While recent studies have shown that children would prefer to read in Arabic, the lack of genre diversity available in Arabic children’s books and online content forces children to consume English publications and media.

Many children have come to perceive reading in Arabic as difficult and boring.

Many UAE publishers have begun to focus on publishing books and digital content for children, but there still remains a shortage of children’s publications in genres such as fairy tales, fantasy, suspense, action, and science fiction. The lack of engaging Arabic children’s books and online content reinforces the use of English and consumption of English language media in the classroom and at home which serves to further erode Arabic proficiency. More diversity in Arabic children’s books can enrich learning, allow children to build on what they learn at school through self-directed reading, and enable parents to complement the role of teachers by reading to their children and encouraging reading for pleasure.

Enhanced capacity of domestic publishers to compete in the educational publishing market is critically important to ensure that Arabic retains its role as a foundation of national identity and to ensure future generations are capable and proficient at leveraging Arabic as an effective tool.

The production of quality, Arabic children’s books and digital content is also essential to complement Arabic teaching with age-appropriate, culturally relevant material to inspire children and help educators teach more effectively.

Building a national culture of reading

Though improving, several studies have found that a national culture of reading for pleasure is still in its early stages. These studies point to a range of issues from household access to books to low involvement of parents in building early childhood reading skills. Beginning in the late-2000s, a number of emirate-level initiatives sprung up to address national reading challenges. While the extent and breadth of these initial efforts to address national reading challenges was ambitious, collaboration and coordination across the many entities and initiatives was lacking. For this reason, the National Reading Law was passed in 2016 to ensure the sustainability of government efforts to build a reading culture and clarify the objectives of government agencies in promoting reading.

The National Reading Law is the foundation for the National Reading Strategy which is backed by $30 million in funding earmarked for 30 national initiatives to support reading and lifelong learning as national values. The National Reading Strategy also deemed 2016 the Year of Reading. The Year of Reading Initiative involves more than 340 major reading initiatives and activities taking place across the country involving over 100 local government entities working in co-ordination with the Higher Supervisory Committees for Year of Reading. The UAE has come a long way in defining a common agenda for promoting a national culture of reading based on localizing promising international best practices.

| Best Practice | Indicative UAE Programs |

|---|---|

| Giving readers choice |

|

| Incentives and awards |

|

| Ensuring an enabling home environment |

|

| Support from schools |

|

| Accessible, modern school and public libraries |

|

Ensuring that implementation of GCC VAT does not negatively affect the industry

In February 2016, the Gulf Cooperation Council countries agreed to introduce a Value Added Tax (VAT) at a rate of 5% in January 2018. While the education sector will be exempt from VAT, which will presumably be extended to textbooks and educational materials, it remains unclear how trade books and the raw materials for publishing will be treated under the new VAT system.

Currently, the UAE does not impose customs on imported books and printed goods.

A key question that must be addressed as e-commerce grows in the UAE and global and regional online marketplaces increase book and digital content sales is how VAT and customs should be imposed on online transactions in the UAE.

A still larger question is whether trade book imports and sales should be exempted from VAT altogether. Another issue that warrants discussion are potential customs and VAT exemptions for critical publishing industry inputs such as paper. Despite these large uncertainties facing the publishing industry surrounding VAT, there have been no policy impact studies conducted by the industry. There are several significant questions surrounding the imposition of VAT on the publishing industry and e-commerce transactions that remain unanswered.