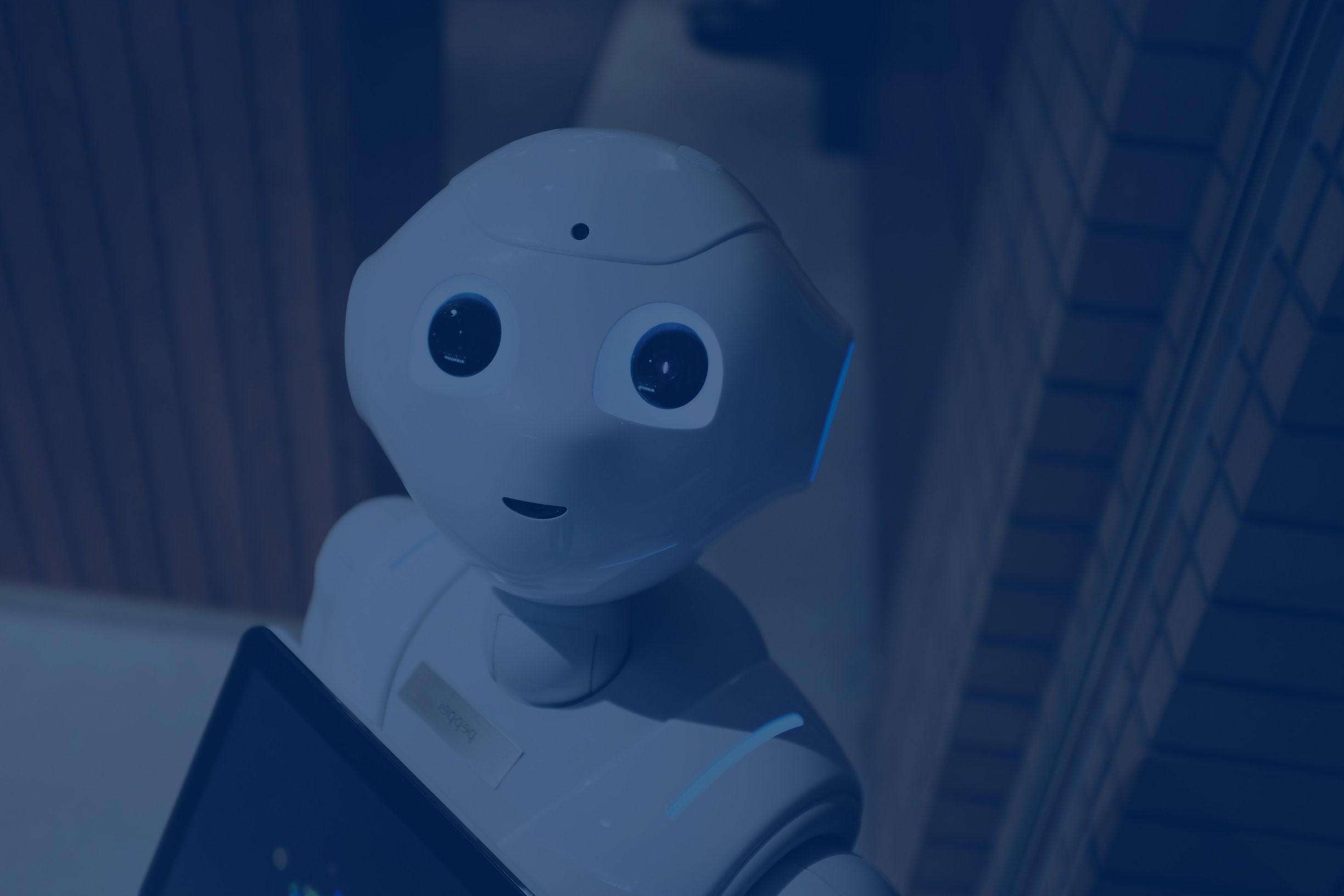

Is Egypt the next hotbed of opportunity for the MENA's booming digital economy?

- Government efforts to liberalize the telecoms market, develop ICT and e-commerce strategies, and attract foreign investment are reaping rewards

- A world-class regulatory foundation remains an essential prerequisite to realizing Egypt's digital economy's enormous potential

Consider these statistics: with approximately 96 million mobile phone users, Egypt has the largest mobile phone subscriber base in the Middle East and North Africa. Smartphone penetration, which is currently at 57%, grew at a CAGR of 25% between 2012 and 2017; likewise, mobile internet use rose at a CAGR of 21% from 2012 to 2016.

Most impressively, 98% of Egyptian internet users now access the internet via mobile phones.

With these figures set to continue rising over the next few years, increasing numbers of global tech firms are looking to enter the Egyptian market, indicating a promising future for Egypt’s digital economy.

Despite these promising trends, internet use is strongly marked by geographic and economic divides. Most Egyptian internet users live in its highly-populated, urban metropolitan areas, with 40% of all Egyptian internet users based in the Greater Cairo Area alone. This geographic disparity reflects urbanization trends, as well as higher household incomes in Egypt’s capital and secondary cities. The Ministry of Communications and Information Technology has highlighted internet affordability as a key factor behind this digital divide, which it is trying to address, that has widened due to the economic downturn that followed the 2011 Revolution.

Moves to liberalize the telecom market in recent years is one promising sign that the government is serious about addressing the digital divide through cheaper prices and modernized services for mobile consumers.

In 2014, the government approved a plan to issue a unified landline and mobile telecoms license, enabling Telecom Egypt (TE) to enter the mobile services market through its subsidiary We. TE also signed a MoU earlier this year allowing Etisalat Misr to provide fixed line services using its infrastructure. In September 2017, Orange, Vodafone, Etisalat, and We launched 4G services. The country’s first 5G pilot was also revealed at Cairo ICT in December 2017, and the National Telecom Regulatory Authority is now considering 5G spectrum licensing.

In a move to support Egypt’s burgeoning digital economy and bridge the digital divide, the government has also put forth the ICT 2030 Strategy and the E-Commerce Strategy. Both strategies aim to enhance digital transformation by supporting the growth of e-payments, cloud tech, e-government, e-commerce, and enhancing connectivity infrastructure.

In particular, the ICT 2030 Strategy aims to revamp and develop national ICT infrastructure.

The strategy has a focus on four core aspects: adopting cloud tech in government e-services; developing and implementing social ICT initiatives; developing local digital content; and providing open-source platforms to build digital infrastructure.

The E-Commerce Strategy, prepared in partnership with UNCTAD, plans to launch an e-commerce business facilitation hub, a national B2C e-marketplace, rural e-commerce development initiatives, and e-payment solutions, as well as boost the IT-enabled services sector. Significantly, the strategy aims for e-commerce to comprise 2.35% of GDP. This is an ambitious target, as only 0.4% of all retail sales in Egypt are currently transacted online, compared to the MENA region average of 1.8%. The strategy has also set the target of ICT making up 7% of GDP by 2030, up from approximately 3% at present.

In a country where nearly 86% of adults are unbanked, efforts to promote e-payment and e-service programs hold significant potential to enhance financial inclusion, reduce poverty, and grow the economy.

The Central Bank of Egypt (CBE) signed an agreement with the Egyptian Financial Supervisory Authority (EFSA) last year to promote financial inclusion and has recently announced that it will license e-payment firms aiming to provide banking services. It is also said to be considering launching its own cryptocurrency, after repeatedly warning that cryptocurrency is illegal. Meanwhile, Egypt’s Information Technology Industry Development Agency (ITIDA) has been working to transform the country into a global hub for technology and business services in partnership with the Ministries of Communications and Information Technology and Investment.

Government efforts to attract foreign investors have already begun to attract global tech companies and funders to Egypt.

ITIDA announced earlier this year that it has formed agreements with six international IT and BPO firms to expand their operations in the country, creating over 3,700 new jobs. Based on the efforts of the Ministries of Communications and Information Technology and Investment, a number of other international firms have also announced plans to step up their investments. US-based ride hailing app Uber said last year that it would invest $20 million in its new Cairo support center, while Indian smartphone manufacturer Lava International recently announced that it is planning to invest $10 million this year. Pan-African firm Liquid Telecom is also planning to extend its “One Africa” land-based fiber network from Cape Town to Cairo, which would provide faster network speeds in Egypt and across Africa. It has also been reported that US-based e-commerce firm Amazon is looking into establishing a logistics center.

As Egypt’s startup ecosystem has gained global attention, international and regional investors have jumped into the fray as well. For example, ride-hailing app Swvl received $8 million this year in Series A funding, the largest venture capital funding round in Egypt to date, from regional venture fund BECO Capital, African investor DiGAME, and global venture capital fund Silicon Badia. Earlier in the year, Samsung acquired AI startup Kngine. Likewise, international investors purchased an 85% stake in Egyptian e-payment platform Fawry for $100 million in 2015.

In addition to enhancing its entrepreneurship ecosystem, Egypt is also trying to build a domestic technology industry. For example, SICO Technology launched the first Egyptian-manufactured smartphone last year, with 45% local component usage, in a bid to target cost conscious consumers.

Despite these ambitious plans and significant investments, the true potential of Egypt’s digital economy is unlikely to be realized in the absence of a world-class regulatory foundation. The government has already prepared a draft law to regulate e-commerce, as only 2% of national e-commerce is currently regulated.

Parliament is considering a 14% VAT on all online transactions, including social media advertisements.

Meanwhile, the Ministry of Finance is reportedly looking into canceling fees on mobile phone line purchases that are slowing mobile adoption. Excessive taxation threatens to discourage e-payments, de-incentivize potential market entrants, and prevent the formalization of the informal sector, while attempts by the Government to compete with the private sector, through sites like Egypt Face – which is believed to be a project of the Government, risk alienating foreign investors and crowding out homegrown entrepreneurs.

In addition to taxation and competition policy-related challenges, the recent passage of the Cybercrime and Press and Media laws are making Egypt’s social media users and digital activists think twice before they share.

A data protection law is in the works, and it will likely be passed during the current parliamentary session. Provisions of the proposed law are unclear at this point, but it will likely have implications for data sharing, monitoring, and storage, and could possibly have data localization requirements similar to China and Russia. In short, all realms of online business, from digital content to user data, are now subject to extreme government oversight, threatening the growth of internet usage and the digital economy more broadly.

While the future looks bright for Egypt’s digital economy, internet affordability and access are pressing priorities in moving forward on the ambitious goals of the ICT 2030 Strategy and the E-Commerce Strategy. There is a need to double down on efforts to attract investments from international tech firms, mobilize further investment by domestic companies, and follow through on digital economy regulatory and investment reforms. If these steps are taken, Egypt’s digital economy will continue its strong growth and may make the country into the region’s next new hotbed for digital startups and innovation.