The UAE is striving to become an Islamic finance hub

- Existing hubs include Thailand, UK, Singapore, Hong Kong, India, France, Canada, Japan, India, China, Nigeria, Malaysia, and Bahrain

- The UAE needs to significantly enhance its current education and training system in order to become a hub

Last week the UAE joined the growing list of global financial hubs which aspire to also become Islamic finance hubs. The list includes countries such as Thailand, UK, Singapore, Hong Kong, India, France, Canada, Japan, India, China, Nigeria, Malaysia, and Bahrain. Despite their aspirations, many of these countries lack the critical financial sector standards and human resources to offer substantial sharia-compliant banking and financial services.

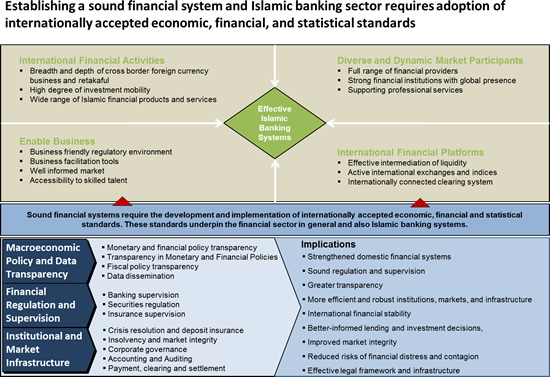

Structural approaches to forming a world-class Islamic banking system are underpinned by sound financial systems rooted in internationally accepted economic, financial, and statistical standards.

Our study of Islamic financial hubs reveals several common structural approaches pursued by Islamic banking leaders:

- Dual Banking Systems: The most successful Islamic banking hubs operate a full-fledged Islamic banking system in parallel with a full-fledged conventional system complete with liberalization measures that also allow foreign banks to operate

- A Step-by-step Approach: Successful Islamic banking hubs have an overall long term strategy to develop a large number of instruments; a large number of institutions; and an Islamic interbank market

- Comprehensive Legislation: Successful Islamic banking hubs pass comprehensive Islamic banking legislation and typically have a common Sharia Supervising Council for all Islamic banks

- A Practical, Open-minded Approach: To complement education and training of potential employees entering the Islamic financial services sector, Islamic banking hubs employ research-based approaches and product experimentation to serve local needs and ensure innovation

- Participation in Forming International Standards: Several Islamic banking hubs have established bodies to internationalize Islamic banking standards which are involved in regulating the global industry and establishing standards involved in furthering Islamic finance training and education

As shown in the figure below, these structural approaches to forming a world-class Islamic banking system are underpinned by sound financial systems rooted in internationally accepted economic, financial, and statistical standards.

Human Resources Frequently Limit Ambitions of Aspiring Islamic Finance Hubs

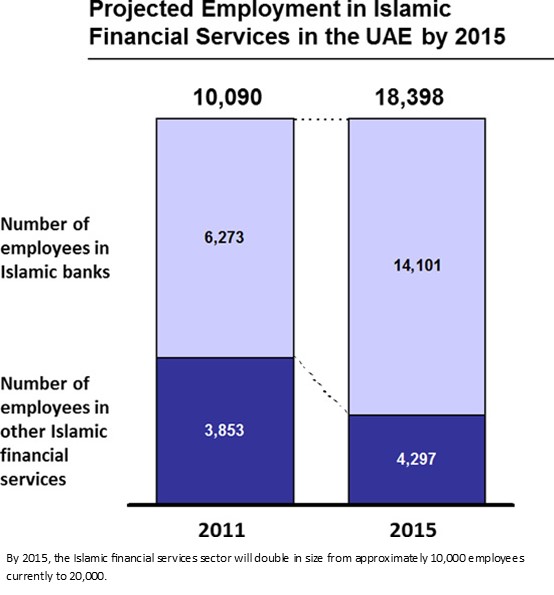

Based on our projections that a another $87 to $124 billion could potentially enter the Islamic banking system in the UAE by 2015, approximately 7,800 new jobs will be created at Islamic banks in the UAE assuming current asset concentration ratios remain similar. We also project another 500 jobs will be created by 2015 in other Islamic financial services segments. By 2015, the Islamic financial services sector will double in size from approximately 10,000 employees currently to 20,000.

| Bank | Est. | 2011 Total Assets in $ | Current Number of Employees | Projected Number of New Employees Needed by 2015 |

|---|---|---|---|---|

| Dubai Islamic bank | 1975 | $24,683,505,177 | 2,000 | 2,522 |

| Sharjah Islamic bank | 1976 | $4,831,918,801 | 412 | 519 |

| Abu Dhabi Islamic bank | 1997 | $20,245,231,608 | 1,200 | 1,513 |

| Emirates Islamic bank (merged with Dubai Bank) | 2004 | $5,853,895,095 | 1,097 | 1,383 |

| Noor Islamic bank | 2007 | $4,598,651,499 | 650 | 820 |

| Al Hilal Islamic bank | 2008 | $7,697,841,417 | 702 | 885 |

| Ajman Islamic bank | 2008 | $1,089,903,815 | 176 | 222 |

| Total | $69,000,947,411 | 6,237 | 7,864 |

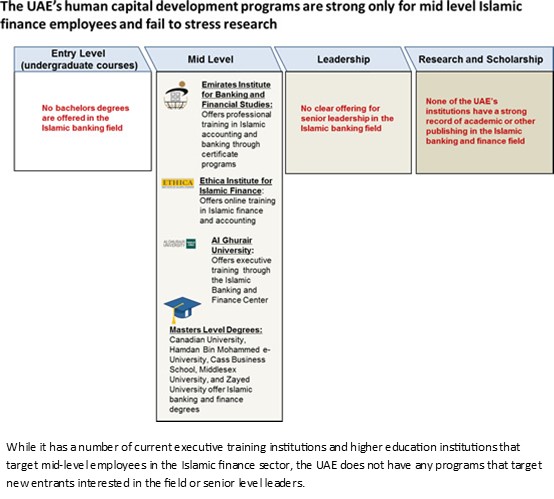

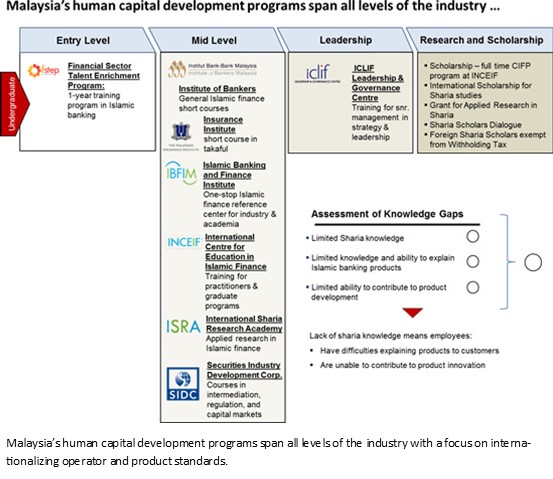

To meet this growing demand for employees trained in Islamic finance, the UAE will need to significantly broaden its education and training options to ensure availability of human capital does not stall the growth of the sector. While it has a number of current executive training institutions and higher education institutions that target mid-level employees in the Islamic finance sector, the UAE does not have any programs that target new entrants interested in the field or senior-level leaders. The UAE also does not have institutions which provide research and analysis that advances the field. The experiences of Bahrain and Malaysia show that research capabilities and institutions have been key structural feature of Islamic banking systems that lead to product innovation and effective regulation. Furthermore, many of the masters programs in Islamic banking and finance in the UAE remain general MBAs or masters degrees with very few specialized courses related to practical aspects of Islamic banking that are required by employers. The exceptions are Zayed University and Hamdan Bin Mohammed e-University which have in-depth course offerings in Islamic finance and economics.

By 2015, the Islamic financial services sector will double in size from approximately 10,000 employees currently to 20,000.

Towards an Islamic Finance Human Capital Development Strategy for the UAE

To solidify its position as an Islamic finance hub amongst the heavy competition, the UAE will need to significantly enhance its current education and training system. This includes human capital development and research programs to ensure:

- Quantitative supply of Islamic banking graduates through expanded undergraduate offerings or financial sector bridge programs that target nonfinance graduates

- High-quality executive training focused on resolving likely skills gaps amongst current employees

- Specific executive training and leadership development training for senior-level bank leaders and regulators to create the necessary vision and Sharia knowledge to enable product innovation

- High-quality research and thought leadership that pushes the boundaries of the sector and allows the UAE to participate in the internationalization of operational and product standards which is currently being led by competing Islamic financial hubs